You better hope the iPhone 7 sells well -- your future retirement savings could fashion and eroticism ideals of feminine beautydepend on it.

Spaceship, which bills itself as the "super fund for millennials," is creating a new style of superannuation fund that will invest predominantly in technology. A super fund is a mandatory way Australians save for old age, somewhat similar to a 401(k) in the U.S., built from contributions by employers and voluntary top ups.

SEE ALSO: How one software startup made it by doing everything backwardsSpaceship is the work of a Sydney-based team with backgrounds in finance and venture capital. Andrew Sellen, CEO and cofounder, told Mashablethe idea emerged over beers, as he and cofounder Dave Kuhn debated whether a new type of super fund could overcome the apathy most young Australians have about their savings.

"If you ask anyone our age where their super is, they've generally got no idea. And then when you ask what companies they own in their super, they have even less of an idea," he said.

Once the startup jumps through the necessary regulatory hoops, they'll build an investment portfolio with "a technology core." "So the biggest names in the list will be companies like Apple, Google, Microsoft, Amazon, Facebook," Sellen said.

"We think in the decades to come, the companies that do best will look a lot more like Apple and Google than the big banks and mining companies that currently dominate Australian super portfolios."

The startup's launch was hailed on social media by some of the biggest names in Australian tech, and it raised a A$1.6 million ($1.2 million) seed funding round with contributions from the likes of Atlassian cofounder Mike Cannon-Brookes.

This Tweet is currently unavailable. It might be loading or has been removed.

This Tweet is currently unavailable. It might be loading or has been removed.

In a company aimed at the 18-35 age bracket, there won't be too many forms to fill out. Everything with Spaceship happens via the Spaceship app, Sellen said, including rolling over your existing super from other funds and being able to see where money is invested down to the dollar amount. He said the signup process would take about 90 seconds.

Like other super funds, Spaceship will charge a fee, but Sellen could not yet disclose the amount.

He added the fund would "definitely" open this year. "We have a few thousand people on the waitlist already," he said. "We think it could grow very quickly. We think we can get a million people in seven to 10 years."

The super industry is certainly due for a shakeup, but should you sign up for Spaceship?

Brad Twentyman, client director at Pitcher Partners, said he thought Spaceship was likely to appeal to a section of the market that is currently disengaged from their super.

Ultimately, he will wait to see the extent of the portfolio's technology focus. "From an investment side, they may be reasonably conservative, which as an advisor wouldn't cause me too many concerns," he told Mashable. "If it was 100 percent tech, I'd be telling people only to put in 5 to 10 percent."

As he pointed out, most super funds don't allow you to pick an industry sector like "tech."

"In a lot of super funds, you can choose to invest in Commonwealth Bank or Apple, but not necessarily an industry," he added. "As an advisor, you tend to tell people they need to be diversified across asset classes and regions and industries.

"It depends how aggressive that tech stuff is, too. If it's your Apples and your Googles, it's different to that really [speculative] tech stuff."

Young people are so immersed in technology, it's an appealing proposition to invest in these sorts of high growth companies, Sellen suggested, especially if your investment goals are longterm. "All stocks are volatile, but the important thing to remember, particularly for our generation, is you've got 30-plus years until you need to access that money," he added.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable In Australia, debate has also been growing about ethical investing, and new super options have emerged that do not invest in companies that contribute overwhelmingly to global warming. While Sellen did not say Spaceship would 100 percent avoid mining companies and the like, he said he believes such companies are not where the world is heading.

"Companies whose business model involves screwing over people or the environment will probably not exist 10 or 20 years from now," he opined.

Simon Sheikh, founder and managing director of Future Super, Australia's first fossil fuel-free super fund, told Mashablehe welcomed innovation in the super space.

He said at Future Super, they've found that by avoiding fossil fuel industries, you necessarily end up having greater exposure to industries like fintech, healthcare and technology. "We're very supportive, but the challenge is, if you're going to invest in the future, you have to stop investing in the past," he said.

After all, technology companies are still multinationals with their own set of priorities. Apple, for example, has faced complaints about its environmental impact, tax practices and its treatment of workers, although in some cases it has actively worked to change its ways.

Sheikh suggested that an ethical super is a constant challenge. "Everyday you've got to wake up, look at your profile and be prepared to divest when the line is drawn," he said. "If you're launching a new fund, you should also have an ethical approach."

The fat bears are already extremely fat

The fat bears are already extremely fat

The Foul, Unclean Caricatures of James Gillray

The Foul, Unclean Caricatures of James Gillray

Google Easter egg pays tribute to the late Betty White

Google Easter egg pays tribute to the late Betty White

The Paris Review Is Going to Chicago’s Printers Row Lit Fest

The Paris Review Is Going to Chicago’s Printers Row Lit Fest

Best robot vacuum deal: Eufy Omni C20 robot vacuum and mop $300 off at Amazon

Best robot vacuum deal: Eufy Omni C20 robot vacuum and mop $300 off at Amazon

Voting rights activists march on D.C. as Bernice King calls out virtue signaling for MLK Day 2022

Voting rights activists march on D.C. as Bernice King calls out virtue signaling for MLK Day 2022

Best Coleman deals: Tents, camping chairs, and beyond for up to 73% off at Amazon

Best Coleman deals: Tents, camping chairs, and beyond for up to 73% off at Amazon

The 11 best and funniest tweets of week, including Kendall Roy, cast iron, and retweets

The 11 best and funniest tweets of week, including Kendall Roy, cast iron, and retweets

Best roborock deal: Save $400 on Q5 Pro+ Robot Vacuum and Mop

Best roborock deal: Save $400 on Q5 Pro+ Robot Vacuum and Mop

Poetry for Robots: Can We Use Verse to Teach Robots to Feel?

Poetry for Robots: Can We Use Verse to Teach Robots to Feel?

This fat bear's before and after photos are stunning

This fat bear's before and after photos are stunning

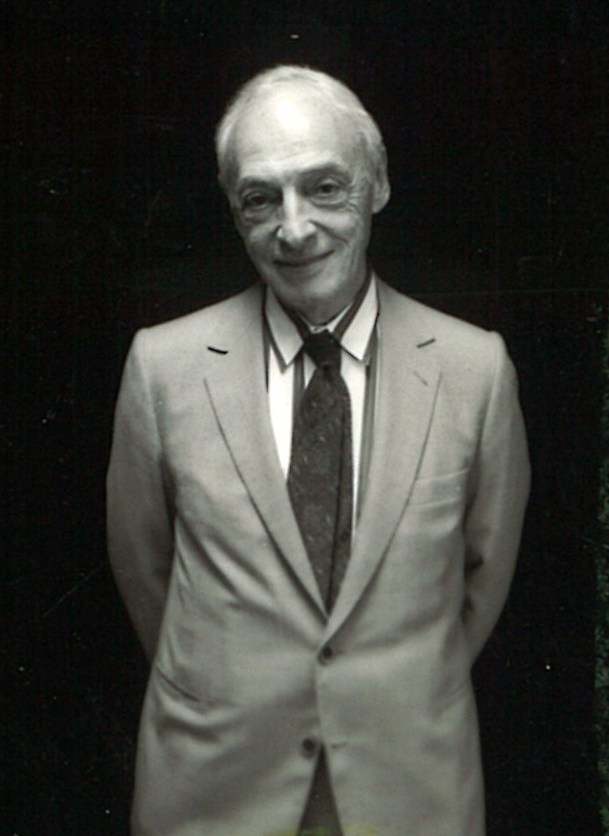

Václav Havel: Outtakes from an Interview by Adam Thirlwell

Václav Havel: Outtakes from an Interview by Adam Thirlwell

New on Our Masthead: Susannah Hunnewell and Adam Thirlwell

New on Our Masthead: Susannah Hunnewell and Adam Thirlwell

Listen: Saul Bellow Reads from “Humboldt’s Gift,” 1988

Listen: Saul Bellow Reads from “Humboldt’s Gift,” 1988

Best headphones deal: Save $116 on Sennheiser Momentum 4

Best headphones deal: Save $116 on Sennheiser Momentum 4

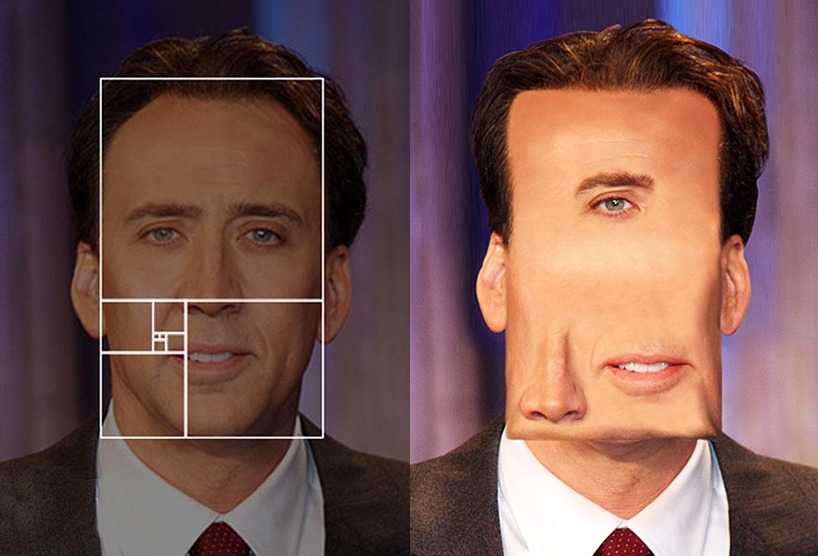

The Golden Ratio—Not Always a Thing of Beauty

The Golden Ratio—Not Always a Thing of Beauty

When Cheever Thought Updike Was Dead

When Cheever Thought Updike Was Dead

When Cheever Thought Updike Was Dead

When Cheever Thought Updike Was Dead

'No One Will Save You' review: Alien home invasion horror without the tension

'No One Will Save You' review: Alien home invasion horror without the tension

Arkadium mini crossword answers for October 2Best Amazon deals of the day: Amazon Echo Hub, Shark FlexStyle, and 55NYT Strands hints, answers for October 4Bill Nye is only taking selfies with climateM3 MacBook Air vs. M3 MacBook Pro: Which Mac is best for you?'Red Rooms' review: Austere giallo for our techNRL Grand Final 2024 livestream: How to watch NRL for freeWTF to watch this weekend: Mashable's top 3 picksWebb telescope snaps view of an exploded star. It's an invaluable find.Today's Hurdle hints and answers for October 3Benfica vs. Atletico Madrid 2024 livestream: Watch Champions League for freeGirona vs. Feyenoord 2024 livestream: Watch Champions League for freeNYT Strands hints, answers for October 4Best earbuds deal: Get a pair of Bose Ultra Open Earbuds for $249 at AmazonWordle today: The answer and hints for October 4Reddit's latest policy change could stifle future protests against the platformReddit's latest policy change could stifle future protests against the platformBuccaneers vs. Falcons 2024 livestream: How to watch NFL for free'Salem's Lot' review: Stephen King adaptation has stereotypes, but also surprisesEarly Prime Day deal: 35% off eero 6+ mesh WiFi routers Watch: Postman gets 'help' from neighbourhood kitty on the daily How did this Australian woman go from the suburbs to mission control? Lenovo launches affordable Moto E3 Power smartphone in India for $120 Boy with Down syndrome scores touchdown as terminally ill mother watches Here's the message Jimmy Kimmel's mom stuffed in those bagged Emmys snacks 10 amenities missing from the real life listing for Harry Potter's home Clever repair shop sign understands your cracked phone screen struggles Did the terror suspect NYC emergency alert fail the clarity test? Tom Brady's son dabbed when he caught a touchdown pass from dad The fastest route to the Vikings' locker room is through a restaurant Jill Soloway compares Trump to Hitler, calls him 'a complete dangerous monster' Man apologises for bigotry outside mosque with a sign of solidarity Rami Malek makes perfect ‘Mr. Robot’ joke while accepting Emmy 'Game of Thrones' wins Emmy for Drama Series because of course it did Huawei nova and nova plus: Mid 'Hearthstone' guides: Steal from your foes with the Peddler Rogue MealPass adds AI, becomes MealPal Joe Biden on terrorist attacks: 'We never bend, we never cower, we never yield' Member of the royal family comes out as gay and makes history Despite warning from police union, Miami players take a knee

1.2129s , 10194.2265625 kb

Copyright © 2025 Powered by 【fashion and eroticism ideals of feminine beauty】,Pursuit Information Network