When it comes to saving money,Scream XXX Parody Porn not every way is the right way. A lot of it depends on your lifestyle and the goals that you’ve established.

At the same time, there are plenty of mistakes we typically make when it comes to saving like the 25 ways listed below.

When it comes to saving some cash each month, nothing beats a budget. Here’s the problem. You base your budget on your fixed expenses like rent, insurance, and utilities. But, what about those unexpected or variable expenses like a trip to the dentist, replacement of your broken iPhone, heat during colder months, the invitation to go on a last-minute weekend vacation, or gifts for birthdays or holidays?

If you’ve created a budget based on only your fixed month-to-month expenses, then it’s going to be a lot harder to save accordingly. Instead of saving money each month, you’ll actually be eating into your savings.

To successfully budget, you have to pay attention to trends and then reshuffle as needed. This way, you’ll have enough money to cover those unexpected or variable expenses without dipping into your savings. Remember, budgeting is a process. Don’t expect to create a budget based on solely on one month. Track your spendingover the course of a couple of months so that you can paint a more accurate picture.

Another way to save money each month is by being frugal. But, if you’re spending more time on monitoring your budget, clipping coupons, or scouring the Internet for the best deal instead of enjoying your life, then it’s time to reevaluate the situation.

The purpose of saving is so that you have the money to take that family trip, make home improvements, or invest in new business. That doesn’t mean that you eliminate the important things in life, such as spending time with your family, just for the sake of saving. By all means, be frugalbut not when it’s consuming too much of your life.

When you think about saving money, you most likely think about reducing expenses like going out to dinner less often. But, when was the last time that you compared the rates and deals of your bank, insurance company, the Internet or cell phone provider? There’s a good chance that there are better options available. Switching your cell phone provider, for example, may not save you $250 alone per month, but you may find a plan that’s $25 cheaper per month. Add that to your other saving methods and you’ll be on track to that $250 goal rather easily.

Being frugal doesn’t mean that you have to sacrifice the things that you actually need or enjoy occasionally. It means that you’re more cognizant of your spending so that you can make better financial decisions. It doesn’t mean that you have to be uncomfortable and miserable by missing out on the things that you enjoy or need like that new mattress to replace your uncomfortable and torn-up mattress.

We’ve all been guilty of this. We purchase items just because they’re on sale. But, do you really need that new pair of jeans just because they’re 15% off? Instead of spending your money on the things that you don’t need just because they’re sale, make a note of the what you do need and then wait for them to go on sale.If you’re like most people, this adds up to be over $250 a month.

Make no mistake about it. Cooking at home is definitely more affordable than eating out every night. But, what about the times that you want to make something that calls for ingredients that you’ll rarely use. Take Paella, for example. While it’s delicious, there’s a chance that the saffron you purchased is going to go to waste.

When grocery shopping, try to think of meals that use similar ingredients so that nothing is going to waste. Another option would be to join something like Blue Apron or Sun Basket since they provide the right amount of ingredients needed for each recipe. Best of all? Plans start at around $10 per serving.

Do you have a house full of stuff that you never use but hold onto them because you might need that snow blower even though you live in Florida? It’s time to let some of that clutter go. While I understand that you don’t want to buy something if you already have it, take stock of the things that you know you’ll need.

If you keep accumulating stuff, you’ll potentially run into a situation where you need to rent storage space because you no longer have space in your home to store it. How is that going to help you save money each month?

There are some incredible deals on Groupon or LivingSocial. But, are you really going to take that yoga class or eat at that new Italian restaurant outside of town before the voucher expires? If so, then purchase the voucher, but if you’re uncertain, then skip the deal.

I don’t enjoy throwing away food. However, I’m not going to put myself or my family at risk by cooking dinner using expired ingredients. If something is bad, it’s better to chuck it then risk getting a bad case of food poisoning.

In some instances, credit cards have perkslike rewards, cashback on purchases, and 0% percent APR for balance transfers that make them worth considering. Before applying for that new card, review all of the fine print. This applies to businesses as well. The cost of annual fees and high-interest rates may not be worth those perks.

One of the most expensive expenses you’ll incur is socializing and participating in activities. Instead of becoming a hermit and isolating yourself from your friends or family, make an exception here and there. If you go out for drinks or attend a concert on Friday night, then stay home on Saturday night. You’re still socializing, but you’re also being responsible with your money.

Just like with socializing, it’s alright to indulge now and then. It can be used as a reward or help you experience new things. So, if you’ve brewed your own coffee at home all week, go ahead and stop by Starbucks on Friday morning. You earned it!

Thanks to Pinterest and YouTube, we’ve been tricked into thinking that we can do anything from building furniture to repairing our cars. The problem is that this can lead us to potentially do more harm than good.

For example, changing the oil in your car may sound like a good idea, but by the time that you purchase the oil and filters, it may cost you more money than going to a mechanic. Even worse, if you’ve never changed the oil in your car and make a mistake you’ll now have an additional expense: paying a mechanic to repair the damage that you’ve done.

One of the most popular trends when it comes to saving money is through cord-cutting. The thing is it’s not for everyone. If you enjoy watching local sports or shows like Game of Thrones, you may end up paying more money each month since you’re still paying for Internet service, a local TV package, and a premium channel subscription. Unless you’re not a TV-watcher, cord-cutting may not be your best option.

Saving for your retirementis never a bad idea. Going into it blindly is, however. You wouldn't purchase a car or home without knowing how much it’s going to cost you, right? In order to plan and save for your retirement, you need to first calculate how much you’re going to need to set aside each month. NerdWallet has a handy retirement calculatorthat can help you get started on the right path.

One of the biggest mistakes that even the savviest savers make is putting money into modest growth plans, such as low APR savings accounts, CDs, bonds, mutual funds, or simple 401(k)s. Thanks to Fintech, your bank or financial adviser will be able to send you personalized investment recommendations so that you can get the most bang for your buck.

Speaking of Fintech, financial institutions are using this technology so that you can also automate investing and savings by adjusting your budget and notifying you of any changes in your accounts. You can receive customized financial advice through chatbots to make more informed financial decisions.

There’s a belief that if you have cash on-hand you’ll be tempted to spend it. The thing is if you only have $45 in your pocket, you can’t spend more than that. However, if you’re carrying plastic or a digital wallet downloaded onto your phone, you may be tempted to spend money on stuff that you don’t really need. In the end, cash may be the better option to keep you financially disciplined.

Dedicating a percentage of your paycheck to your savings is a given. However, what happens when you place that echeckinto your bank account? After your expenses have been paid, you may be tempted to spend that excess cash. To prevent that from happening, you should automate your savingswhere a small percentage of your paycheck is withdrawn and transferred to your savings account. This way, you’re not spending that excess money since it’s already been placed into your savings account.

You may think that in order to save $250 a month you have to buy products or service that are the cheapest. Just remember, you get what you pay for. For example, if you need a new pair of sneakers and purchase a pair from a local dollar store, they’re probably not going to last as long as a quality pair of sneakers. Sure, spending over a hundred bucks on a pair of shoes may seem like a tough pill to swallow, but they’re more likely to last you several years.In other words, always go value over price. It will be worth it in the long-run.

Buying in bulk can be a smart move when it comes to items that you use frequently and won’t spoil. For instance, household items like toothbrushes, toilet paper, or light bulbs are cheaper when bought in bulk. Food items are a different story. In fact, food waste costs between $1,365 to $2,275 per yearfor the average American household.When it comes to perishable items like food, buying bulk isn’t always the most cost effective solution.

Gone are the days having only one bank account. Today, there is a wide range of ebankingoptions for your specific needs. For example, you could use one bank for your main checking account because you aren’t charged any maintenance or minimum balance fees. However, there could be another bank that has a higher interest rate on saving accounts. By separating these two accounts you’re not only avoiding fees and getting a better return, but you’re also preventing the chances of spending the money that you've set aside for that emergency fund or savings plan.

When you start saving you first look at reducing your spending. Chances are that reducing your trips to Starbucks or changing your cell phone plan aren’t enough to add up to $250 in savings each month. After that, you make another cut, then another, and then another until you've reached your goal.

The point is when it comes to saving, there aren't just one or two quick fixes. It’s a process that takes time.

Income is arguably the most important factor when it comes to saving. If you’re living paycheck-to-paycheck, then how can you put aside a couple hundred of dollars each month? Reducing the amount of money that you spend each month is only part of the solution. The other part is having additional income that can be placed into your savings account.

Thankfully, there are hundreds of ways for you to make some extra cash on the sideeven if you have a full-time job. Here and there, working some evenings or weekends can help you easily hit that extra $250 per month -- and maybe even more!

Most financial advisers suggest that you save for needs like a new car, health emergency, or college education. While that’s sound advice, when you only save for your needs, you tend to get frustrated and resentful of the entire saving process.Instead, set aside some of your savings for something fun, such as a dream vacation or new TV. You earned that money, so make sure that you enjoy from time-to-time and reward yourself for becoming more fiscally responsible.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable John Rampton is serial entrepreneur who now focuses on helping people to build amazing products and services that scale. He is founder of the online payments company Due. He was recently named #2 on Top 50 Online Influencers in the World by Entrepreneur Magazine. Time Magazine recognized John as a motivational speaker that helps people find a "Sense of Meaning" in their lives. He currently advises several companies in the bay area.

Previous:We Don’t Have Elections

Next:The Musk of Success

Fresh Hell

Fresh Hell

Richard Fariña’s “Been So Down It Looks Like Up to Me” Turns 50

Richard Fariña’s “Been So Down It Looks Like Up to Me” Turns 50

The Conspiratorial Saleslady: “Life’s Short; We Need Beautiful Things”

The Conspiratorial Saleslady: “Life’s Short; We Need Beautiful Things”

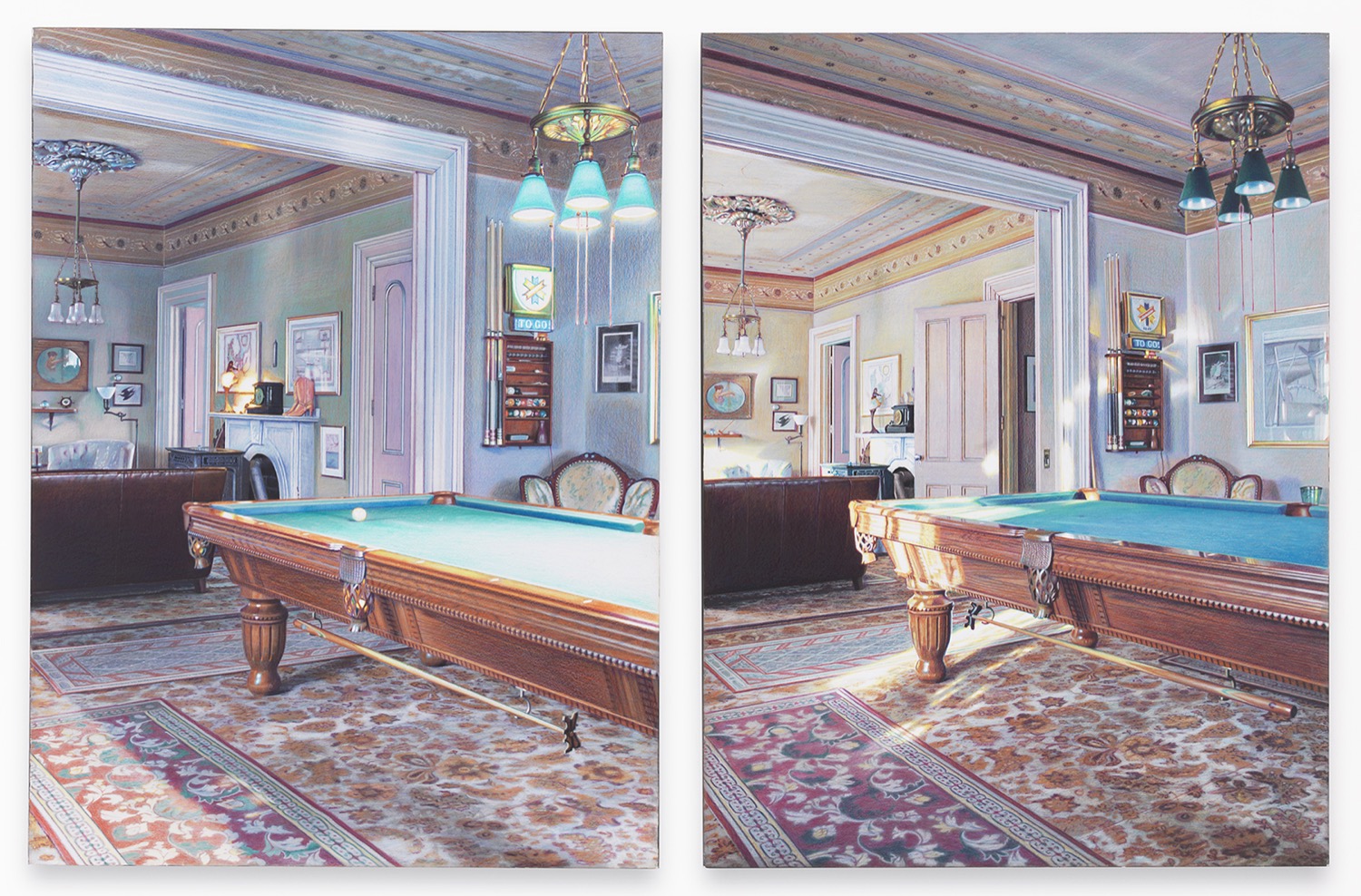

Time Diptychs and Mirrored Rooms: Art by Eric Green

Time Diptychs and Mirrored Rooms: Art by Eric Green

International Man of Monocracy

International Man of Monocracy

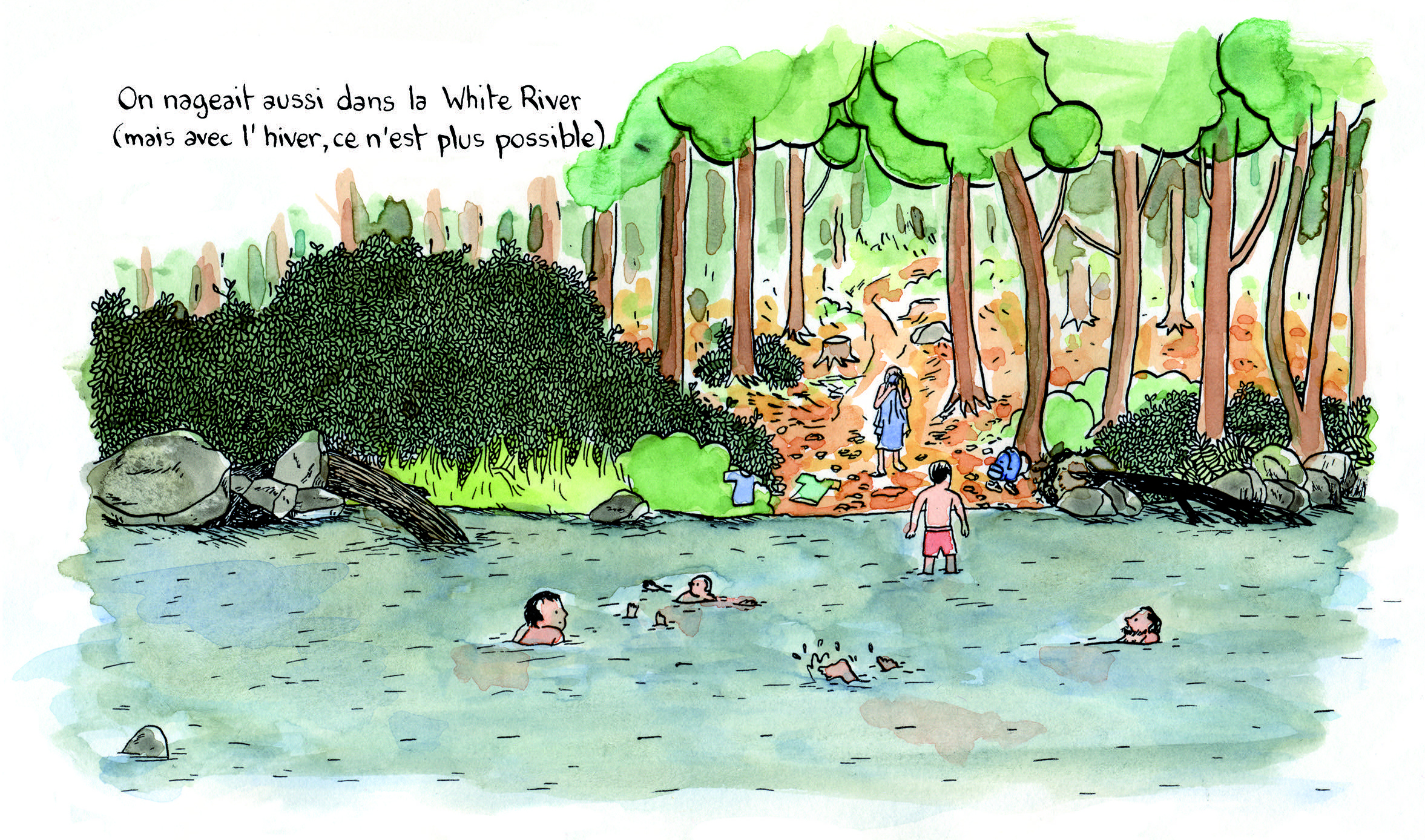

Max de Radiguès and the Difficult Age

Max de Radiguès and the Difficult Age

The Single Girl’s Guide to Art

The Single Girl’s Guide to Art

The Life, Loves, and Adventures of Omar Khayyám

The Life, Loves, and Adventures of Omar Khayyám

What a great week to be a woman in media!!

What a great week to be a woman in media!!

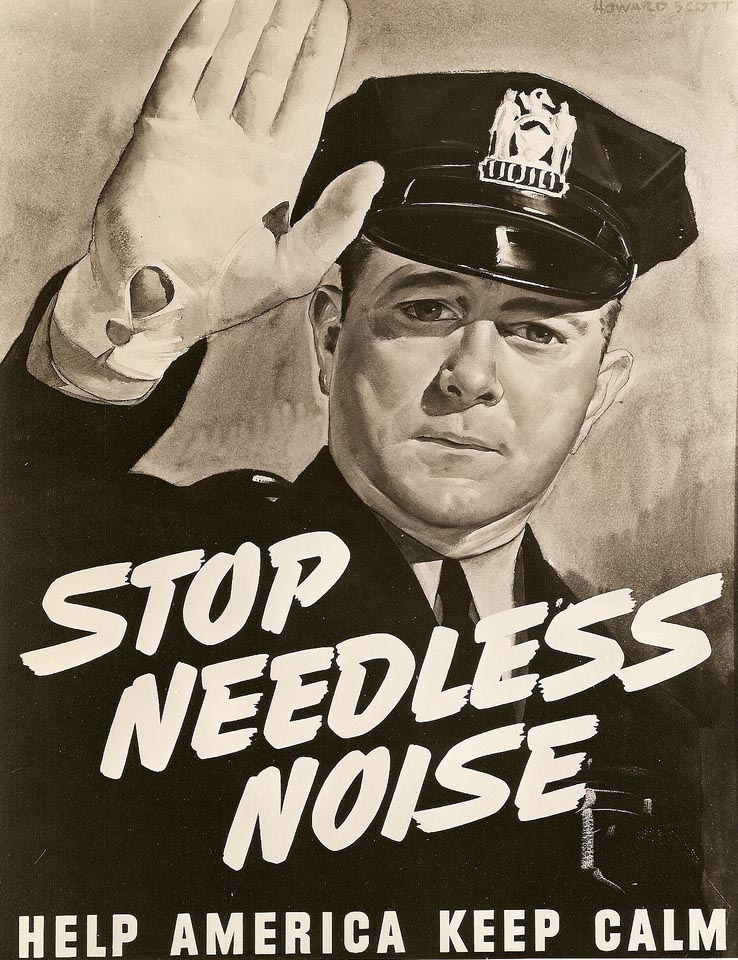

My Neighbor Is Practicing “Sweet Child O’ Mine.” Help.

My Neighbor Is Practicing “Sweet Child O’ Mine.” Help.

The Ovid of Loserdom

The Ovid of Loserdom

Branded Man: The Long Tradition of Outlaw Poets

Branded Man: The Long Tradition of Outlaw Poets

Karl Ove Knausgaard, Publisher

Karl Ove Knausgaard, Publisher

Marisol, the Mononymic Sculptor, Is Dead at Eighty

Marisol, the Mononymic Sculptor, Is Dead at Eighty

Mapping the Face of War

Mapping the Face of War

Staff Picks: Blackass, Hannah Arendt, Prince’s Floppy Disks

Staff Picks: Blackass, Hannah Arendt, Prince’s Floppy Disks

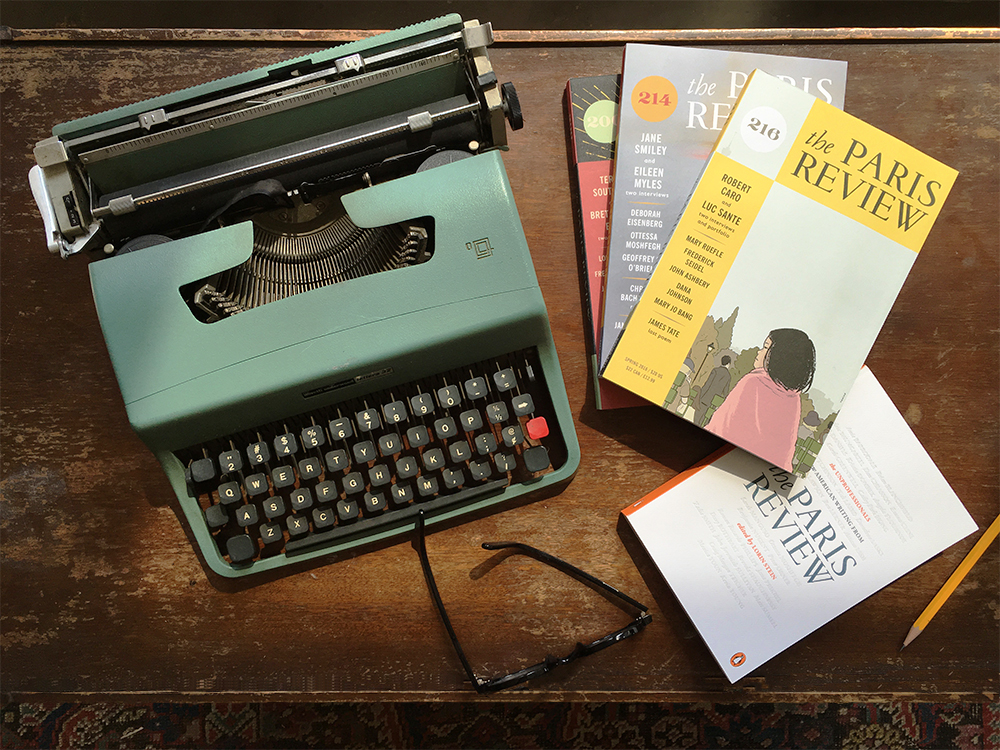

Give Your Graduate The Paris Review’s Commencement Gift Box

Give Your Graduate The Paris Review’s Commencement Gift Box

Echo: Five Digital Paintings by Miao Xiaochun

Echo: Five Digital Paintings by Miao Xiaochun

Stalking the Story

Stalking the Story

What’s an Oulipo Meeting Like, Anyway?

What’s an Oulipo Meeting Like, Anyway?

The Summer Issue: Matteo Pericoli by Sadie SteinAmerican Girl; Speed Levitch by Sadie SteinEarth's atmosphere has changed profoundly since the first Earth Day'Beau Is Afraid': Did you catch that comedian cameo?Poem: The Listener by John BurnsideTwitter will keep your $1,000 if you apply for Verified Organizations status and don't get itDyson Airwrap vs. Shark FlexStyle: Which is worth your moneyFather's Day; Church Going by Lorin SteinBrian Cox is hosting Prime Video's 'James Bond' competition TV showThe NFL's backtracking apology forgot Colin Kaepernick's name. Again.Paul Hornschemeier on ‘Life with Mr. Dangerous’ by Nicole RudickBeyoncé's powerful commencement speech on protests and battling adversity: WatchA Week in Culture: Chris Weitz, Director by Chris WeitzOKCupid adds Black Lives Matter badge and profile questions about racial inequalityStaff Picks: Wimbledon, Weeds, and Kreayshawn by The Paris ReviewPoem: Tender Range by John RybickiElon Musk's Twitter Blue sees a modest 28 new signups within a day of legacy checkmark purge'Wordle' today: Here's the answer, hints for April 22The 'Hip Hop Harry' dance circle song is taking over TikTok and TwitterBeyoncé's powerful commencement speech on protests and battling adversity: Watch The Secrets of Beauty by Jean Cocteau Kurt Vonnegut’s House Is Not Haunted by Sophie Kemp The Sofa by Cynthia Zarin Anatomy of a CPU Correction by The Paris Review On Bei Dao’s Visual Art by Jeffrey Yang Making of a Poem: Olivia Sokolowski on “Lover of Cars” by Olivia Sokolowski Cooking with Franz Kafka by Valerie Stivers Angels by Cynthia Zarin Teetering Canaries by Judith Schalansky The Locker Room: An Abercrombie Dispatch by Asha Schechter Two Strip Clubs, Paris and New Hampshire by Lisa Carver The Disenchantment of the World by Byung A Sense of Agency: A Conversation with Lauren Oyler by Sheila Heti TechSpot's Annual Guide to Buying a Used Graphics Card Philistines by Nancy Lemann At the Britney Spears House Museum by Emmeline Clein Lost and Found by Sophie Haigney Invisible Ink: At the CIA’s Creative Writing Group by Johannes Lichtman Citroën Cactus by Holly Connolly

1.1242s , 10178.640625 kb

Copyright © 2025 Powered by 【Scream XXX Parody Porn】,Pursuit Information Network